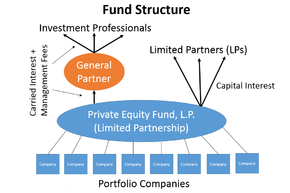

Carried interest, or carry, in finance, is a share of the profits of an investment paid to the investment manager specifically in alternative investments (private equity and hedge funds). It is a performance fee, rewarding the manager for enhancing performance.[3] Since these fees are generally not taxed as normal income, some believe that the structure unfairly takes advantage of favorable tax treatment, e.g. in the United States.[4]

- ^ Fleischer, Victor (2008). "Two and Twenty: Taxing Partnership Profits in Private Equity Funds". New York University Law Review. SSRN 892440.

- ^ Batchelder, Lily. "Business Taxation: What is carried interest and how should it be taxed?". Tax Policy Center. Retrieved 5 March 2014.

- ^ Lemke, Lins, Hoenig and Rube, Hedge Funds and Other Private Funds: Regulation and Compliance, §13:20 (Thomson West, 2013–2014 ed.).

- ^ Cite error: The named reference

corpfininstwas invoked but never defined (see the help page).