| |

| Long title | An Act to provide for the establishment of Federal reserve banks, to furnish an elastic currency, to afford means of rediscounting commercial paper, to establish a more effective supervision of banking in the United States, and for other purposes |

|---|---|

| Enacted by | the 63rd United States Congress |

| Citations | |

| Public law | [63-43 Pub. L. 63–43] |

| Statutes at Large | ch. 6, 38 Stat. 251 |

| Legislative history | |

| |

| Major amendments | |

| Dodd–Frank Wall Street Reform and Consumer Protection Act Economic Growth, Regulatory Relief and Consumer Protection Act | |

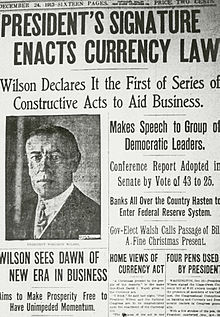

The Federal Reserve Act was passed by the 63rd United States Congress and signed into law by President Woodrow Wilson on December 23, 1913. The law created the Federal Reserve System, the central banking system of the United States.

The Panic of 1907 convinced many Americans [who?] of the need to establish a central banking system, which the country had lacked since the Bank War of the 1830s. After Democrats won unified control of Congress and the presidency in the 1912 elections, President Wilson, Congressman Carter Glass, and Senator Robert Latham Owen crafted a central banking bill that occupied a middle ground between the Aldrich Plan, which called for private control of the central banking system, and progressives like William Jennings Bryan, who favored government control over the central banking system. Wilson made the bill a top priority of his New Freedom domestic agenda, and he helped ensure that it passed both houses of Congress without major amendments.

The Federal Reserve Act created the Federal Reserve System, consisting of twelve regional Federal Reserve Banks jointly responsible for managing the country's money supply, making loans and providing oversight to banks, and serving as a lender of last resort. To lead the Federal Reserve System, the act established the Federal Reserve Board of Governors, members of which are appointed by the president. The 1933 Banking Act amended the Federal Reserve Act to create the Federal Open Market Committee, which oversees the Federal Reserve's open market operations. A later amendment requires the Federal Reserve "to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates."