| Part of a series on |

| Accounting |

|---|

|

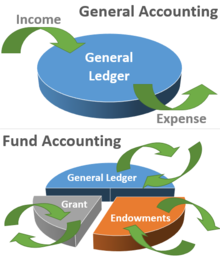

Fund accounting is an accounting system for recording resources whose use has been limited by the donor, grant authority, governing agency, or other individuals or organisations or by law.[1] It emphasizes accountability rather than profitability, and is used by nonprofit organizations and by governments. In this method, a fund consists of a self-balancing set of accounts and each are reported as either unrestricted, temporarily restricted or permanently restricted based on the provider-imposed restrictions.

The label fund accounting has also been applied to investment accounting, portfolio accounting or securities accounting – all synonyms describing the process of accounting for a portfolio of investments such as securities, commodities and/or real estate held in an investment fund such as a mutual fund or hedge fund.[2][3] Investment accounting, however, is a different system, unrelated to government and nonprofit fund accounting.

- ^ Leon E. Hay (1980). Accounting for Governmental and Nonprofit Entities, Sixth edition, page 5. Richard D. Irwin, Inc., Homewood, IL. ISBN 0-256-02329-8

- ^ IFRS for Investment Funds Deloitte Development LLC (2008). See "Challenges and Opportunities for Investment Funds" on p. 3. Retrieved 2010-05-17

- ^ Hedge Funds Accounting. Archived 2018-06-13 at the Wayback Machine Green Trader Funds. Retrieved 2010-05-17