The United States dollar was established as the world's foremost reserve currency by the Bretton Woods Agreement of 1944. It claimed this status from sterling after the devastation of two world wars and the massive spending of the United Kingdom's gold reserves. Despite all links to gold being severed in 1971, the dollar continues to be the world's foremost reserve currency. Furthermore, the Bretton Woods Agreement also set up the global post-war monetary system by setting up rules, institutions and procedures for conducting international trade and accessing the global capital markets using the US dollar.

The US dollar is widely held by central banks, foreign companies and private individuals worldwide, in the form of eurodollar foreign deposit accounts (not to be confused with the euro), as well as in the form of US$100 notes, an estimated 75% of which are held overseas.[1] The US dollar is predominantly the standard currency unit in which goods are quoted and traded, and with which payments are settled in, in the global commodity markets.[2]

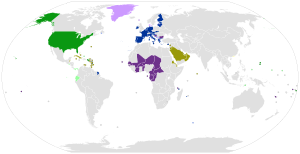

The US dollar is also the official currency in several countries and the de facto currency in many others, with Federal Reserve Notes (and, in a few cases, US coins) used in circulation.

The monetary policy of the United States is conducted by the Federal Reserve System, which acts as the nation's central bank.

- ^ "The Death of Cash? Not So Fast: Demand for U.S. Currency at Home and Abroad, 1990-2016" (PDF). www.econstor.eu/. 2017-05-25. p. 8. Retrieved 2017-05-25.

- ^ Kowalski, Chuck (February 11, 2020). "Impact of the Dollar on Commodities Prices". The Balance.