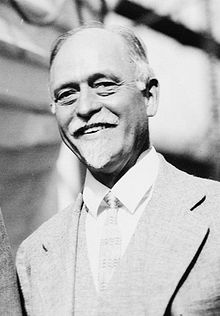

Irving Fisher | |

|---|---|

Fisher photographed by George Grantham Bain in 1927 | |

| Born | February 27, 1867 |

| Died | April 29, 1947 (aged 80) |

| Nationality | American |

| Spouse |

Margaret Hazard

(m. 1893; died 1940) |

| Academic career | |

| Field | Mathematical economics |

| Institution | Yale University[1] |

| School or tradition | Neoclassical economics |

| Alma mater | Yale University (BA, PhD) |

| Doctoral advisor | Josiah Willard Gibbs William Graham Sumner |

| Influences | William Stanley Jevons, Eugen von Böhm-Bawerk |

| Contributions | Fisher equation Equation of exchange Price index Debt deflation Phillips curve Money illusion Fisher separation theorem Independent Party of Connecticut |

| Part of a series on |

| Macroeconomics |

|---|

|

Irving Fisher (February 27, 1867 – April 29, 1947)[1] was an American economist, statistician, inventor, eugenicist and progressive social campaigner. He was one of the earliest American neoclassical economists, though his later work on debt deflation has been embraced by the post-Keynesian school.[2] Joseph Schumpeter described him as "the greatest economist the United States has ever produced",[3] an assessment later repeated by James Tobin[4] and Milton Friedman.[5]

Fisher made important contributions to utility theory and general equilibrium.[6][7] He was also a pioneer in the rigorous study of intertemporal choice in markets, which led him to develop a theory of capital and interest rates.[4] His research on the quantity theory of money inaugurated the school of macroeconomic thought known as "monetarism".[8] Fisher was also a pioneer of econometrics, including the development of index numbers. Some concepts named after him include the Fisher equation, the Fisher hypothesis, the international Fisher effect, the Fisher separation theorem and Fisher market.

Fisher was perhaps the first celebrity economist, but his reputation during his lifetime was irreparably harmed by his public statement, just nine days before the Wall Street Crash of 1929, that the stock market had reached "a permanently high plateau". His subsequent theory of debt deflation as an explanation of the Great Depression, as well as his advocacy of full-reserve banking and alternative currencies, were largely ignored in favor of the work of John Maynard Keynes.[4] Fisher's reputation has since recovered in academic economics, particularly after his theoretical models were rediscovered in the late 1960s to the 1970s, a period of increasing reliance on mathematical models within the field.[4][9][10] Interest in him has also grown in the public due to an increased interest in debt deflation after the Great Recession.[11]

Fisher was one of the foremost proponents of the full-reserve banking, which he advocated as one of the authors of A Program for Monetary Reform where the general proposal is outlined.[12][13]

- ^ a b Cite error: The named reference

IFObit1947was invoked but never defined (see the help page). - ^ Keen, Steve (2012). "Growth Theory". In King, J. E. (ed.). The Elgar Companion to Post Keynesian Economics (2nd ed.). Edward Elgar. pp. 271–277. ISBN 978-1-84980-318-2.

- ^ Schumpeter, Joseph (1951). Ten Great Economists from Marx to Keynes. New York: Oxford University Press. p. 223.

- ^ a b c d Tobin, James (1987), "Fisher, Irving (1867–1947)", The New Palgrave Dictionary of Economics: 369–376, doi:10.1057/9780230226203.0581, ISBN 978-0-333-78676-5

- ^ Milton Friedman, Money Mischief: Episodes in Monetary History, Houghton Mifflin Harcourt (1994) p. 37. ISBN 0-15-661930-X

- ^ George Stigler (1950). "The Development of Utility Theory. I". Journal of Political Economy. 58 (4): 307–327. doi:10.1086/256962. JSTOR 1828885. S2CID 153732595.

- ^ George Stigler (1950). "The Development of Utility Theory. II". Journal of Political Economy. 58 (5): 373–396. doi:10.1086/256980. JSTOR 1825710. S2CID 222450704.

- ^ J. Bradford DeLong (2000). "The Triumph of Monetarism?". Journal of Economic Perspectives. 14 (1): 83–94. doi:10.1257/jep.14.1.83. JSTOR 2647052.

- ^ Jack Hirshleifer (1958). "The Theory of Optimal Investment Decisions". Journal of Political Economy. 66 (4): 329–352. doi:10.1086/258057. S2CID 154033914.

- ^ Ben Bernanke, Essays on the Great Depression, (Princeton: Princeton University Press, 2000), p. 24. ISBN 0-691-01698-4.

- ^ Out of Keynes's shadow, The Economist, Feb 12th 2009

- ^ Dorn, James A. (17 January 2019). "Irving Fisher's Search for Stable Money: What We Can Learn". Cato Institute. Retrieved 5 June 2019.

- ^ Douglas, Paul H.; Hamilton, Earl J.; Fisher, Irving; King, Willford I.; Graham, Frank D.; Whittlesey, Charles R. (July 1939), A Program for Monetary Reform (PDF), (draft proposal – scanned image)., archived from the original (PDF) on 2011-07-26