This article has multiple issues. Please help improve it or discuss these issues on the talk page. (Learn how and when to remove these messages)

|

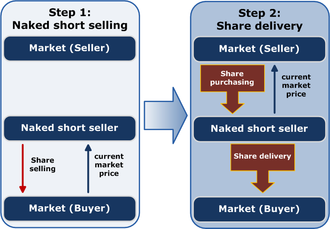

Naked short selling, or naked shorting, is the practice of short-selling a tradable asset of any kind without first borrowing the asset from someone else or ensuring that it can be borrowed. When the seller does not obtain the asset and deliver it to the buyer within the required time frame, the result is known as a "failure to deliver" (FTD). The transaction generally remains open until the asset is acquired and delivered by the seller, or the seller's broker settles the trade on their behalf.[1]

Short selling is used to take advantage of perceived arbitrage opportunities or to anticipate a price fall, but exposes the seller to the risk of a price rise.

Critics have advocated for stricter regulations against naked short selling. In 2005 in the United States, "Regulation SHO" was enacted, requiring that broker-dealers have grounds to believe that shares will be available for a given stock transaction, and requiring that delivery take place within a limited time period.[2][3] In 2008, the SEC banned what it called "abusive naked short selling"[4] in the United States, as well as some other jurisdictions, as a method of driving down share prices. Failing to deliver shares is legal under certain circumstances, and naked short selling is not per se illegal.[5][2][6] In the United States, naked short selling is covered by various SEC regulations which prohibit the practice.[7]

In August 2008, the SEC issued a temporary order restricting short-selling in the shares of 19 financial firms deemed systemically important, by reinforcing the penalties for failing to deliver the shares in time.[8] Effective September 18, amid claims that aggressive short selling had played a role in the failure of financial giant Lehman Brothers, the SEC extended and expanded the rules to remove exceptions and to cover all companies, including market makers.[4][9]

A 2014 study by researchers at the University at Buffalo, published in the Journal of Financial Economics, found no evidence that failure to deliver stock "caused price distortions or the failure of financial firms during the 2008 financial crisis" and that "greater FTDs lead to higher liquidity and pricing efficiency, and their impact is similar to our estimate of delivered short sales".[10]

Some commentators have contended that despite regulations, naked shorting is widespread and that the SEC regulations are poorly enforced.[11] Its critics have contended that the practice is susceptible to abuse, can be damaging to targeted companies struggling to raise capital, and has led to numerous bankruptcies.[7][12] However, other commentators have said that the naked shorting issue is a "devil theory",[13] not a bona fide market issue and a waste of regulatory resources.[14]

- ^ Knepper, Zachary T. (2004). "Future-Priced Convertible Securities & The Outlook For "Death-Spiral" Securities-Fraud Litigation" (pdf). Bepress Legal Repository. Berkeley Electronic Press. p. 15.

- ^ a b "Key Points About Regulation SHO". Securities and Exchange Commission. April 11, 2005. Retrieved 2008-10-19.

- ^ "Division of Market Regulation: Responses to Frequently Asked Questions Concerning Regulation SHO". Securities and Exchange Commission. Retrieved 2008-10-19.

- ^ a b SEC Takes Steps to Curtail Abusive Short Sales and Increase Market Transparency, Securities and Exchange Commission, July 27, 2009

- ^ "Testimony of Mary Schapiro, Financial Crisis Inquiry Commission" (PDF). Financial Crisis Inquiry Commission. Jan 14, 2010. p. 22. Retrieved 16 April 2011.

- ^ Emshwiller, John R. & Scannell, Kara (July 5, 2007). "Blame the 'Stock Vault'?". The Wall Street Journal.

- ^ a b Ellis, David (September 17, 2008). "SEC puts 'naked' short sellers on notice". CNN. Retrieved 2008-09-23.

- ^ "Searching for the naked truth", The Economist, August 17, 2008

- ^ Gordon, Marcy (September 18, 2008). "New SEC Rules Target 'Naked' Short-Selling". Associated Press.

- ^ Fotak, Veljko; Raman, Vikas; Yadav, Pradeep K. (2014). "Fails-to-deliver, short selling, and market quality" (PDF). Journal of Financial Economics. 114 (3): 493–516. doi:10.1016/j.jfineco.2014.07.012.

- ^ Stokes, Alexis Brown (Spring 2009). "In Pursuit of the Naked Short". Rochester, NY. SSRN 1769014.

{{cite journal}}: Cite journal requires|journal=(help) - ^ Kadlec, Daniel (9 November 2005). "Watch Out, They Bite!". Time. Archived from the original on April 24, 2008.

- ^ Cite error: The named reference

Bankinvestorswas invoked but never defined (see the help page). - ^ Cite error: The named reference

Donlanwas invoked but never defined (see the help page).