The examples and perspective in this article deal primarily with the United States and do not represent a worldwide view of the subject. (October 2021) |

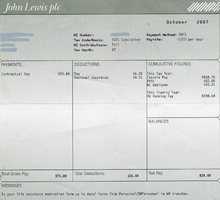

A payroll is a list of employees of a company who are entitled to receive compensation as well as other work benefits, as well as the amounts that each should obtain.[1] Along with the amounts that each employee should receive for time worked or tasks performed, payroll can also refer to a company's records of payments that were previously made to employees, including salaries and wages, bonuses, and withheld taxes,[2] or the company's department that deals with compensation. A company may handle all aspects of the payroll process in-house or can outsource aspects to a payroll processing company.

Payroll in the U.S. is subject to federal, state and local regulations including employee exemptions, record keeping, and tax requirements.[3]

- ^ "Definition of PAYROLL". www.merriam-webster.com. Retrieved 2019-11-04.

- ^ Bragg, Steven M. (2003). Essentials of Payroll: Management and Accounting. John Wiley & Sons. ISBN 0471456144. Retrieved 4 November 2017.

- ^ "Employee Payroll Laws". smallbusiness.chron.com. Retrieved 2019-11-05.