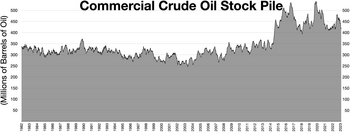

Large build in stock in late 2014

The 2010s oil glut was a significant surplus of crude oil that started in 2014–2015 and accelerated in 2016, with multiple causes. They include general oversupply as unconventional US and Canadian tight oil (shale oil) production reached critical volumes, geopolitical rivalries among oil-producing nations, falling demand across commodities markets due to the deceleration of the Chinese economy, and possible restraint of long-term demand as environmental policy promotes fuel efficiency and steers an increasing share of energy consumption away from fossil fuels.

The world price of oil was above US$125 per barrel ($790/m3) in 2012, and remained relatively strong above $100 until September 2014, after which it entered a sharp downward spiral, falling below $30 by January 2016. OPEC production was poised to rise further with the lifting of international sanctions against Iran, at a time when markets already appeared to be oversupplied by at least 2 million barrels (320,000 m3) per day.[1]

In December 2015, The Daily Telegraph quoted a major oil broker saying, "The world is floating in oil. The numbers we are facing now are dreadful."[2] Forbes magazine said, "The ongoing oil price slump has more or less morphed into a complete rout, with profound long-term implications for the industry as a whole."[3]

As 2016 continued, the price gradually rose back into the $40s, with the world waiting to see if and when and how the market would return to balance.[4]

In October 2018, Brent prices had recovered to their pre-2015 levels, peaking[5] at $86.29 a barrel on 3 October. Soon after, however, prices began a collapse as fears over the global economy and fast-increasing shale production began to take hold.

In the following month, Brent prices fell approximately 22%, constituting the largest monthly loss in a decade, ending the month at $59.46 per barrel on 30 November.[6]

In early 2022, Brent prices had recovered to their pre-2015 levels for a second time, exceeding the prices reached in October 2018.

- ^ Kalantari, Hashem; Sergie, Mohammed (2 January 2016). "Iran Says Post-Sanctions Crude Output Boost Won't Hurt Prices". Bloomberg News. Retrieved 16 January 2016.

- ^ Evans-Pritchard, Ambrose (29 December 2015). "Goldman eyes $20 oil as glut overwhelms storage sites". The Daily Telegraph. Retrieved 29 December 2015.

- ^ Sharma, Gaurav (11 December 2015). "Oil Market Rout: Winners, Losers And Cost Implications For 2016". Forbes. Retrieved 29 December 2015.

- ^ "OPEC Basket Daily Archives". OPEC. Retrieved 21 May 2016.

- ^ "Market Insider Daily Archives". Business Insider. Retrieved 3 October 2018.

- ^ Saefong, Myra P. "Oil prices drop 22% in November for biggest monthly loss in a decade". MarketWatch. Retrieved 6 December 2018.