The examples and perspective in this article deal primarily with the United States and do not represent a worldwide view of the subject. (June 2022) |

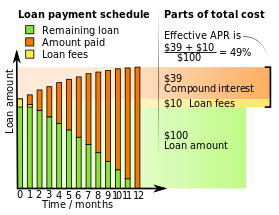

The term annual percentage rate of charge (APR),[1][2] corresponding sometimes to a nominal APR and sometimes to an effective APR (EAPR),[3] is the interest rate for a whole year (annualized), rather than just a monthly fee/rate, as applied on a loan, mortgage loan, credit card,[4] etc. It is a finance charge expressed as an annual rate.[5][6] Those terms have formal, legal definitions in some countries or legal jurisdictions, but in the United States:[3]

- The nominal APR is the simple-interest rate (for a year).

- The effective APR is the fee+compound interest rate (calculated across a year).[3]

In some areas, the annual percentage rate (APR) is the simplified counterpart to the effective interest rate that the borrower will pay on a loan. In many countries and jurisdictions, lenders (such as banks) are required to disclose the "cost" of borrowing in some standardized way as a form of consumer protection. The (effective) APR has been intended to make it easier to compare lenders and loan options.

- ^ "EUR-Lex - 51996AC1091 - EN". eur-lex.europa.eu.

- ^ "Justice and Consumers". European Commission - European Commission.

- ^ a b c "Subject: Regulation AA", Alfred F."Bob" Blair, Jr., US Federal Reserve, 2008-06-28, webpage: US-Federal-Reserve-R1314.

- ^ "What is APR on a Credit Card? – Credit Police". 2023-10-14. Retrieved 2023-10-20.

- ^ O'Sullivan, Arthur; Steven M. Sheffrin (2010). Economics: Principles in action. Upper Saddle River, New Jersey: Prentice Hall. p. 514. ISBN 978-0-13-063085-8.[dead link]

- ^ "What is the APR in the loan?". vclick.vn.