This article has multiple issues. Please help improve it or discuss these issues on the talk page. (Learn how and when to remove these messages)

|

| This article is part of a series on |

| Corporate law |

|---|

|

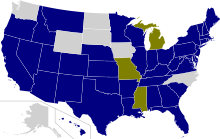

Passed into law.

No existing law.

Bill failed a vote in the state's legislature.

In business, and only in United States corporate law, a benefit corporation (or in some states, a public benefit corporation) is a type of for-profit corporate entity whose goals include making a positive impact on society. Laws concerning conventional corporations typically do not define the "best interest of society", which has led some to believe that increasing shareholder value (profits and/or share price) is the only overarching or compelling interest of a corporation.[1] Benefit corporations explicitly specify that profit is not their only goal.[2] An ordinary corporation may change to a benefit corporation merely by stating in its approved corporate bylaws that it is a benefit corporation.[2]

A company chooses to become a benefit corporation in order to operate as a traditional for-profit business while simultaneously addressing social, economic, and/or environmental needs.[3] For example, a 2013 study done by MBA students at the University of Maryland showed that one main reason businesses in Maryland had chosen to file as benefit corporations was for community recognition of their values.[4] A benefit corporation's directors and officers operate the business with the same authority and behavior as in a traditional corporation, but are required to consider the impact of their decisions not only on shareholders but also on employees, customers, the community, and the local and global environment. For an example of what additional impacts directors and officers are required to consider, view the Maryland Code § 5-6C-07 – Duties of director. The nature of the business conducted by the corporation does not affect its status as a benefit corporation. Instead, it provides a justification for including public benefits in their missions and activities.

The benefit corporation legislation ensures that a director is required to consider other public benefits in addition to profit, preventing shareholders from using a drop in stock value as evidence for dismissal or a lawsuit against the corporation. Transparency provisions require benefit corporations to publish annual benefit reports of their social and environmental performance using a comprehensive, credible, independent, and transparent third-party standard. However, few of the states have included provisions for the removal of benefit corporation status or fines if the companies fail to publish benefit reports that comply with the state statutes.[5]

Currently, there are no legal standards that define what constitutes a benefit corporation.[6] A benefit corporation need not be certified or audited by the third-party standard. Instead, it may use third-party standards solely as a rubric to measure its own performance. Some authors have pointed out that in the current 36 states that recognize benefit corporations, the laws requiring certification for operation differ from state to state.[7] For example, in the state of Indiana, there is no requirement for certification from a third party needed to operate as a benefit corporation.[8] Other research has indicated a synergy between a benefit corporation and employee ownership.[9]

As a matter of law, in the 36 states that recognize this form of business, a benefit corporation is intended "to merge the traditional for-profit business corporation model with a non-profit model by allowing social entrepreneurs to consider interests beyond those of maximizing shareholder wealth."[2]

- ^ Pearlstein, Steven (September 6, 2013). "Businesses' focus on maximizing shareholder value has numerous costs". The Washington Post. Archived from the original on February 7, 2015. Retrieved December 3, 2018.

- ^ a b c Lee, Jaime (May 2018). "Benefit Corporations: A Proposal for Assessing Liability in Benefit Enforcement Proceedings". Cornell Law Review. 103 (4): 1075–1100. ISSN 0010-8847.

- ^ Bagley, Constance E. (2018). The Entrepreneur's Guide to Law & Strategy, fifth edition. Boston, MA: Cengage Learning, Inc. pp. 56–58. ISBN 978-1-285-42849-9.

- ^ Kincaid, Amy; et al. (January 1, 2013). "Maryland Benefit Corporation Act: The State of Social Enterprise in Maryland". Slideshare. Retrieved October 9, 2019.

- ^ Murray, J. Haskell (2022). "Enforcing Benefit Corporation Reporting". Transactions: The Tennessee Journal of Business Law (23): 505.

- ^ "What is a Benefit Corporation?". www.nolo.com. Retrieved May 24, 2024.

- ^ Cite error: The named reference

:8was invoked but never defined (see the help page). - ^ "Indiana Benefit Corporations: The What, How and Whether of Forming a B-Corp". Freitag & Martoglio. September 21, 2017. Retrieved March 25, 2020.

- ^ Kurland, Nancy (2018). "ESOP plus benefit corporations: Ownership culture with benefit accountability". California Management Review. 60 (4): 51–73. doi:10.1177/0008125618778853. S2CID 158057120.