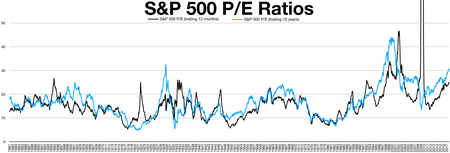

The cyclically adjusted price-to-earnings ratio, commonly known as CAPE,[1] Shiller P/E, or P/E 10 ratio,[2] is a stock valuation measure usually applied to the US S&P 500 equity market. It is defined as price divided by the average of ten years of earnings (moving average), adjusted for inflation.[3] As such, it is principally used to assess likely future returns from equities over timescales of 10 to 20 years, with higher than average CAPE values implying lower than average long-term annual average returns.

The ratio was invented by American economist Robert J. Shiller.

The ratio is used to gauge whether a stock, or group of stocks, is undervalued or overvalued by comparing its current market price to its inflation-adjusted historical earnings record.

It is a variant of the more popular price to earning ratio and is calculated by dividing the current price of a stock by its average inflation-adjusted earnings over the last 10 years.

Using average earnings over the last decade helps to smooth out the impact of business cycles and other events and gives a better picture of a company's sustainable earning power.

It is not intended as an indicator of impending market crashes, although high CAPE values have been associated with such events.[4]

- ^ Evans, Richard (28 Jun 2014). "Super Isas are here - is it the worst time to buy?". The Telegraph. Retrieved 4 July 2014.

- ^ Cite error: The named reference

investopediawas invoked but never defined (see the help page). - ^ "Price to 10 Year Inflation Adjusted Earnings". VectorGrader.com. Archived from the original on 13 July 2014. Retrieved 4 July 2014.

- ^ Shiller, R The Mystery of Lofty Stock Market Elevations New York Times 14 Aug 2014