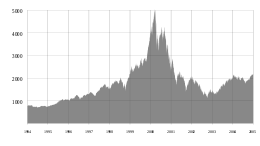

The dot-com bubble (or dot-com boom) was a stock market bubble that ballooned during the late-1990s and peaked on Friday, March 10, 2000. This period of market growth coincided with the widespread adoption of the World Wide Web and the Internet, resulting in a dispensation of available venture capital and the rapid growth of valuations in new dot-com startups. Between 1995 and its peak in March 2000, investments in the NASDAQ composite stock market index rose by 800%, only to fall 78% from its peak by October 2002, giving up all its gains during the bubble.

During the dot-com crash, many online shopping companies, notably Pets.com, Webvan, and Boo.com, as well as several communication companies, such as Worldcom, NorthPoint Communications, and Global Crossing, failed and shut down.[1][2] Others, like Lastminute.com, MP3.com and PeopleSound remained through its sale and buyers acquisition. Larger companies like Amazon and Cisco Systems lost large portions of their market capitalization, with Cisco losing 80% of its stock value.[2][3]

- ^ "The greatest defunct Web sites and dotcom disasters". CNET. June 5, 2008. Archived from the original on August 28, 2019. Retrieved February 10, 2020.

- ^ a b Kumar, Rajesh (December 5, 2015). Valuation: Theories and Concepts. Elsevier. p. 25.

- ^ Powell, Jamie (March 8, 2021). "Investors should not dismiss Cisco's dot com collapse as a historical anomaly". Financial Times. Archived from the original on December 10, 2022. Retrieved April 6, 2022.