This article needs to be updated. (February 2024) |

| Part of a series on |

| Taxation |

|---|

|

| An aspect of fiscal policy |

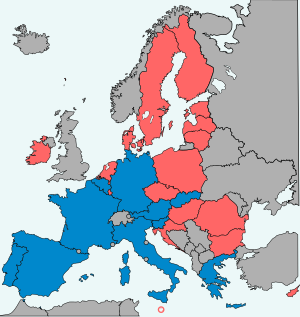

The European Union financial transaction tax (EU FTT) is a proposal made by the European Commission to introduce a financial transaction tax (FTT) within some of the member states of the European Union (EU).

The proposed EU financial transaction tax would be separate from a bank levy, or a resolution levy, which some governments are proposing to impose on banks to insure them against the costs of any future bailouts. It was initially claimed the tax, as proposed, would raise 57 billion Euros per year if implemented across the entire EU.[1]

The first proposal for the whole of the EU was presented by the European Commission in 2011 but did not reach a majority.[2] Instead, the Council of the European Union authorized member states who wished to introduce the EU FTT to use enhanced co-operation.[3] The Commission proposed a directive for an EU FTT in 2013 but the proposal stalled.[2] In 2019 Germany and France released a proposal based on the French financial transaction tax and the finance ministers of the states participating in the enhanced cooperation came to the consensus that the EU FTT should be negotiated using this proposal.[2]

According to early plans, the tax would impact financial transactions between financial institutions charging 0.1% against the exchange of shares and bonds and 0.01% across derivative contracts, if just one of the financial institutions resides in a member state of the EU FTT. To avoid an unwanted negative impact on the real economy, the FTT will not apply to:[4]

- Day-to-day financial activities of citizens and businesses (e.g. loans, payments, insurance, deposits etc.).

- Investment banking activities in the context of raising capital.

- Transactions carried out as part of restructuring operations.

- Refinancing transactions with central banks and the ECB, with the EFSF and the ESM, and transactions with EU.

- ^ Rebecca Christie; Jim Brunsden (8 November 2011). "EU Transaction Tax Debate Highlights Euro-Area Disagreement". Bloomberg Businessweek. Archived from the original on 1 May 2014. Retrieved 22 November 2011.

- ^ a b c "State of play of the financial transaction tax". Eur_lex. 7 June 2019. Retrieved 11 November 2019.

- ^ "2013/52/EU: Council Decision of 22 January 2013 authorising enhanced cooperation in the area of financial transaction tax". Eur-Lex. 22 January 2013. Retrieved 11 November 2019.

- ^ "Financial Transaction Tax under Enhanced Cooperation: Commission sets out the details". European Commission. 14 February 2013. Retrieved 14 February 2013.