| Policy of | European Union |

|---|---|

| Type | Monetary union |

| Currency | Euro |

| Established | 1 January 1999 |

| Members | |

| Governance | |

| Monetary authority | Eurosystem |

| Political oversight | Eurogroup |

| Statistics | |

| Area | 2,801,552 km2 (1,081,685 sq mi)[1] |

| Population | 350,077,581 (January 1, 2024)[2] |

| Density | 125/km2 (323.7/sq mi) |

| GDP (nominal) | €14.372 trillion €40,990 (per capita) (2023)[3] |

| Interest rate | 4.00%[4] |

| Inflation | 2.4% (March 2024)[5] |

| Unemployment | 6.5% (February 2024)[6] |

| Trade balance | €310 billion trade surplus[7] |

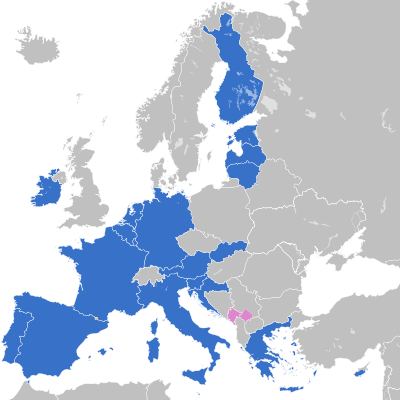

The euro area,[8] commonly called the eurozone (EZ), is a currency union of 20 member states of the European Union (EU) that have adopted the euro (€) as their primary currency and sole legal tender, and have thus fully implemented EMU policies.

The 20 eurozone members are:

- Austria, Belgium, Croatia, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain.

The seven non-eurozone members of the EU are Bulgaria, the Czech Republic, Denmark, Hungary, Poland, Romania, and Sweden. They continue to use their own national currencies, although all but Denmark are obliged to join once they meet the euro convergence criteria.[9]

Among non-EU member states, Andorra, Monaco, San Marino, and Vatican City have formal agreements with the EU to use the euro as their official currency and issue their own coins.[10][11][12] In addition, Kosovo and Montenegro have adopted the euro unilaterally, relying on euros already in circulation rather than minting currencies of their own.[13] These six countries, however, have no representation in any eurozone institution.[14]

The Eurosystem is the monetary authority of the eurozone, the Eurogroup is an informal body of finance ministers that makes fiscal policy for the currency union, and the European System of Central Banks is responsible for fiscal and monetary cooperation between eurozone and non-eurozone EU members. The European Central Bank (ECB) makes monetary policy for the eurozone, sets its base interest rate, and issues euro banknotes and coins.

Since the financial crisis of 2007–2008, the eurozone has established and used provisions for granting emergency loans to member states in return for enacting economic reforms.[15] The eurozone has also enacted some limited fiscal integration; for example, in peer review of each other's national budgets. The issue is political and in a state of flux in terms of what further provisions will be agreed for eurozone change. No eurozone member state has left, and there are no provisions to do so or to be expelled.[16]

- ^ Land cover overview by NUTS 2 regions Eurostat

- ^ "Population on 1 January". Eurostat.

- ^ Cite error: The named reference

europa1was invoked but never defined (see the help page). - ^ Cite error: The named reference

interest rateswas invoked but never defined (see the help page). - ^ Euro area annual inflation and its main components - estimated Eurostat

- ^ Harmonised unemployment rate by gender – total Eurostat

- ^ "Eurozone Current Account Surplus Falls In December". 18 February 2022.

- ^ "Countries, languages, currencies". Interinstitutional style guide. the EU Publications Office. Retrieved 2 February 2009.The euro area Archived 6 August 2013 at the Wayback Machine, European Central Bank

- ^ "Who can join and when?". European Commission – European Commission. Retrieved 2 December 2020.

- ^ "Agreements on monetary relations (Monaco, San Marino, the Vatican and Andorra)". European Communities. 30 September 2004. Retrieved 12 September 2006.

- ^ "The government announces a contest for the design of the Andorran euros". Andorra Mint. 19 March 2013. Archived from the original on 22 August 2013. Retrieved 26 March 2013.

- ^ "Nouvelles d'Andorre" (in French). 1 February 2013. Archived from the original on 4 October 2013. Retrieved 2 February 2013.

- ^ "The euro outside the euro area". Europa (web portal). Retrieved 15 February 2021.

- ^ A glossary (Archived 14 May 2013 at the Wayback Machine) issued by the ECB defines "euro area", without mention of Monaco, San Marino, or the Vatican.

- ^ "Financial assistance to EU Member States | Fact Sheets on the European Union | European Parliament". www.europarl.europa.eu. 30 April 2024. Retrieved 30 August 2024.

- ^ Fox, Benjamin (1 February 2013). "Dutch PM: Eurozone needs exit clause". EUobserver.com. Retrieved 18 June 2013.