Financial contagion refers to "the spread of market disturbances – mostly on the downside – from one country to the other, a process observed through co-movements in exchange rates, stock prices, sovereign spreads, and capital flows".[1] Financial contagion can be a potential risk for countries who are trying to integrate their financial system with international financial markets and institutions. It helps explain an economic crisis extending across neighboring countries, or even regions.

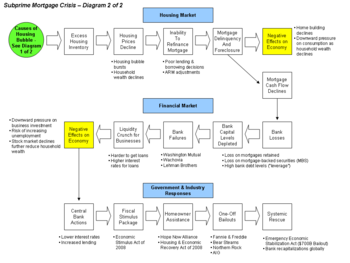

Financial contagion happens at both the international level and the domestic level. At the domestic level, usually the failure of a domestic bank or financial intermediary triggers transmission when it defaults on interbank liabilities and sells assets in a fire sale, thereby undermining confidence in similar banks. An example of this phenomenon is the subsequent turmoil in the United States financial markets.[2] International financial contagion, which happens in both advanced economies and developing economies, is the transmission of financial crisis across financial markets for direct or indirect economies. However, under today's financial system, with the large volume of cash flow, such as hedge fund and cross-regional operation of large banks, financial contagion usually happens simultaneously both among domestic institutions and across countries. The cause of financial contagion usually is beyond the explanation of real economy, such as the bilateral trade volume.[3]

The term financial contagion has created controversy throughout the past years. Some argue that strong linkages between countries are not necessarily financial contagion, and that financial contagion should be defined as an increase in cross-market linkages after a shock to one country, which is very hard to figure out by both theoretical model and empirical work. Also, some scholars argue that there is actually no contagion at all, just a high level of market co-movement in all periods, which is market "interdependence".[4]

More generally, there is controversy surrounding the usefulness of "contagion" as a metaphor to describe the "catchiness" of social phenomena, as well as debate about the application of context-specific models and concepts from biomedicine and epidemiology to explain the diffusion of perturbations within financial systems.[5]

- ^ Dornbusch, Rudiger; Park, Yung; Claessens, Stijn (2000). "Contagion: Understanding How It Spreads" (PDF). The World Bank Research Observer. 15 (2): 177–197. CiteSeerX 10.1.1.202.9824. doi:10.1093/wbro/15.2.177. Archived from the original (PDF) on 25 April 2012. Retrieved 17 December 2014.

- ^ Scott, Hal S. (November 20, 2012). "Interconnectedness and Contagion". Regulation of Financial Institutions eJournal. doi:10.2139/ssrn.2178475. S2CID 166391855. SSRN 2178475.

- ^ Robert Kollmann & Frédéric Malherbe, 2011. "International Financial Contagion: the Role of Banks, "Working Papers ECARES 2011-001, Universite Libre de Bruxelles.

- ^ Cite error: The named reference

Forbes-Rigobonwas invoked but never defined (see the help page). - ^ Peckham, Robert (2013). "Economies of Contagion: Financial Crisis and Pandemic". Economy and Society. 42 (2): 226–248. doi:10.1080/03085147.2012.718626. S2CID 154448749.