This article needs to be updated. (December 2016) |

| This article is part of a series on the |

| Budget and debt in the United States of America |

|---|

|

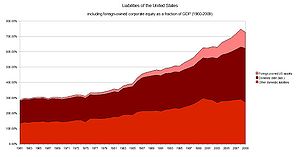

The financial position of the United States includes assets of at least $269 trillion (1576% of GDP) and debts of $145.8 trillion (852% of GDP) to produce a net worth of at least $123.8 trillion (723% of GDP).[a] GDP in 2014 Q1 decline was due to foreclosures and increased rates of household saving. There were significant declines in debt to GDP in each sector except the government, which ran large deficits to offset deleveraging or debt reduction in other sectors.[1]

As of 2009, there was $50.7 trillion of debt owed by US households, businesses, and governments, representing more than 3.5 times the annual gross domestic product of the United States.[2] As of the first quarter of 2010, domestic financial assets[b] totaled $131 trillion and domestic financial liabilities $106 trillion.[3] Tangible assets in 2008 (such as real estate and equipment) for selected sectors[c] totaled an additional $56.3 trillion.[5]

Cite error: There are <ref group=lower-alpha> tags or {{efn}} templates on this page, but the references will not show without a {{reflist|group=lower-alpha}} template or {{notelist}} template (see the help page).

- ^ Roxburgh, Charles; Lund, Susan; Daruvala, Toos; Manyika, James; Dobbs, Richard; Forn, Ramon; Croxson, Karen (January 2012). Debt and De-leveraging: Uneven Progress on the Path to Growth (Report). McKinsey Global Institute. Retrieved March 24, 2013.

- ^ Federal Reserve, Components of US debt, retrieved 3 July 2010

- ^ Federal Reserve, Flow of Funds report (PDF), p. L.5, L.125, archived from the original (PDF) on 1 November 2017, retrieved 3 July 2010

- ^ Federal Reserve, Tangible (non-financial) assets of the United States, retrieved 3 July 2010

- ^ Federal Reserve, Net worth of the United States, retrieved 3 July 2010