| |

| Company type | Government-sponsored enterprise and public company |

|---|---|

| OTCQB: FMCC | |

| Industry | Financial services |

| Founded | 1970 |

| Headquarters | Tysons, Virginia, U.S. (McLean mailing address) |

Key people |

|

| Products | Mortgage-backed securities |

| Revenue | |

| Total assets | |

| Total equity | |

Number of employees | 7,799 (January 31, 2023) |

| Website | freddiemac.com |

| Footnotes / references [1][2] | |

The Federal Home Loan Mortgage Corporation (FHLMC), commonly known as Freddie Mac, is an American publicly traded, government-sponsored enterprise (GSE), headquartered in Tysons, Virginia.[3][4] The FHLMC was created in 1970 to expand the secondary market for mortgages in the US. Along with its sister organization, the Federal National Mortgage Association (Fannie Mae), Freddie Mac buys mortgages, pools them, and sells them as a mortgage-backed security (MBS) to private investors on the open market. This secondary mortgage market increases the supply of money available for mortgage lending and increases the money available for new home purchases. The name "Freddie Mac" is a variant of the FHLMC initialism of the company's full name that was adopted officially for ease of identification.

On September 7, 2008, Federal Housing Finance Agency (FHFA) director James B. Lockhart III announced he had put Fannie Mae and Freddie Mac under the conservatorship of the FHFA (see Federal takeover of Fannie Mae and Freddie Mac). The action has been described as "one of the most sweeping government interventions in private financial markets in decades".[5][6][7] As of the start of the conservatorship, the United States Department of the Treasury had contracted to acquire US$1 billion in Freddie Mac senior preferred stock, paying at a rate of 10% per year, and the total investment may subsequently rise to as much as US$100 billion.[8] Shares of Freddie Mac stock, however, plummeted to about one U.S. dollar on September 8, 2008, and dropped a further 50% on June 16, 2010, when the stocks delisted due to falling below minimum share prices for the NYSE.[9] In 2008, the yield on U.S Treasury securities rose in anticipation of increased U.S. federal debt.[10] The housing market and economy eventually recovered, making Freddie Mac profitable once again.

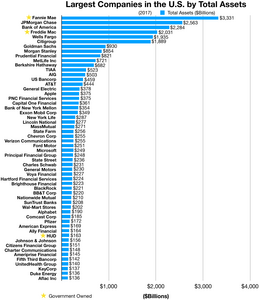

Freddie Mac is ranked No. 45 on the 2023 Fortune 500 list of the largest United States corporations by total revenue, and has $3.208 trillion in assets under management.[11]

- ^ "Federal Home Loan Mortgage Corporation 2022 Annual Report (Form 10-K)" (PDF). February 22, 2023. Retrieved June 10, 2023.

- ^ "Lance F. Drummond Elected Chair of Freddie Mac" (Press release). McLean, VA: Freddie Mac. Globe Newswire. November 7, 2023. Retrieved March 15, 2024.

- ^ "Tysons Corner CDP, Virginia Archived 2011-11-10 at the Wayback Machine". United States Census Bureau. Retrieved on May 7, 2009.

- ^ "Contact Us Archived 2009-05-14 at the Wayback Machine". Freddie Mac. Retrieved on May 12, 2009.

- ^ Lockhart III, James B. (September 7, 2008). "Statement of FHFA Director James B. Lockhart". Federal Housing Finance Agency. Archived from the original on September 12, 2008. Retrieved September 7, 2008.

- ^ "Fact Sheet: Questions and Answers on Conservatorship" (PDF). Federal Housing Finance Agency. September 7, 2008. Archived from the original (PDF) on September 9, 2008. Retrieved September 7, 2008.

- ^ Goldfarb, Zachary A.; David Cho; Binyamin Appelbaum (September 7, 2008). "Treasury to Rescue Fannie and Freddie: Regulators Seek to Keep Firms' Troubles From Setting Off Wave of Bank Failures". The Washington Post. pp. A01. Retrieved September 7, 2008.

- ^ Christie, Rebecca (September 7, 2008). "Paulson Engineers U.S. Takeover of Fannie, Freddie (Update4)". Bloomberg. Retrieved September 7, 2008.

- ^ Adler, Lynn (June 16, 2010). "Fannie Mae, Freddie Mac to delist shares on NYSE". Reuters. Retrieved June 16, 2010.

- ^ Grynbaum, Michael; Jolly, David (September 8, 2008). "U.S. Takeover of Mortgage Giants Lifts Stock Markets". The New York Times. Retrieved September 8, 2008.

- ^ "Freddie Mac". Fortune. Retrieved June 10, 2023.