This article needs additional citations for verification. (July 2008) |

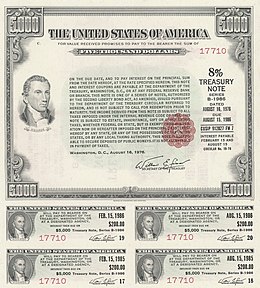

A government bond or sovereign bond is a form of bond issued by a government to support public spending. It generally includes a commitment to pay periodic interest, called coupon payments, and to repay the face value on the maturity date.

For example, a bondholder invests $20,000, called face value or principal, into a 10-year government bond with a 10% annual coupon; the government would pay the bondholder 10% interest ($2000 in this case) each year and repay the $20,000 original face value at the date of maturity (i.e. after 10 years).

Government bonds can be denominated in a foreign currency or the government's domestic currency. Countries with less stable economies tend to denominate their bonds in the currency of a country with a more stable economy (i.e. a hard currency). All bonds carry default risk; that is, the possibility that the government will be unable to pay bondholders. Bonds from countries with less stable economies are usually considered to be higher risk. International credit rating agencies provide ratings for each country's bonds. Bondholders generally demand higher yields from riskier bonds. For instance, on May 24, 2016, 10-year government bonds issued by the Canadian government offered a yield of 1.34%, while 10-year government bonds issued by the Brazilian government offered a yield of 12.84%.

Governments close to a default are sometimes referred to as being in a sovereign debt crisis.[1][2]

- ^ "What is Sovereign Debt". Archived from the original on 2020-07-02. Retrieved 2014-08-02.

- ^ "Portugal sovereign debt crisis". Archived from the original on 2014-08-10. Retrieved 2014-08-02.