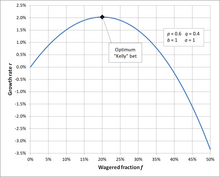

In probability theory, the Kelly criterion (or Kelly strategy or Kelly bet) is a formula for sizing a sequence of bets by maximizing the long-term expected value of the logarithm of wealth, which is equivalent to maximizing the long-term expected geometric growth rate. John Larry Kelly Jr., a researcher at Bell Labs, described the criterion in 1956.[1]

The practical use of the formula has been demonstrated for gambling,[2][3] and the same idea was used to explain diversification in investment management.[4] In the 2000s, Kelly-style analysis became a part of mainstream investment theory[5] and the claim has been made that well-known successful investors including Warren Buffett[6] and Bill Gross[7] use Kelly methods.[8] Also see intertemporal portfolio choice. It is also the standard replacement of statistical power in anytime-valid statistical tests and confidence intervals, based on e-values and e-processes.

- ^ Kelly, J. L. (1956). "A New Interpretation of Information Rate" (PDF). Bell System Technical Journal. 35 (4): 917–926. doi:10.1002/j.1538-7305.1956.tb03809.x.

- ^ Thorp, E. O. (January 1961), "Fortune's Formula: The Game of Blackjack", American Mathematical Society

- ^ Thorp, Edward O. (1966). Beat the dealer: a winning strategy for the game of twenty-one: a scientific analysis of the world-wide game known variously as blackjack, twenty-one, vingt-et-un, pontoon, or van-john. New York: Random House. ISBN 0-394-70310-3. OCLC 655875.

- ^ Thorp, Edward O.; Kassouf, Sheen T. (1967), Beat the Market: A Scientific Stock Market System (PDF), Random House, ISBN 0-394-42439-5, archived from the original (PDF) on 2009-10-07, page 184f.

- ^ Zenios, S. A.; Ziemba, W. T. (2006), Handbook of Asset and Liability Management, North Holland, ISBN 978-0-444-50875-1

- ^ Pabrai, Mohnish (2007), The Dhandho Investor: The Low-Risk Value Method to High Returns, Wiley, ISBN 978-0-470-04389-9

- ^ Thorp, E. O. (September 2008), "The Kelly Criterion: Part II", Wilmott Magazine

- ^ Cite error: The named reference

Poundstone book articlewas invoked but never defined (see the help page).