| Cycle/wave name | Period (years) |

|---|---|

| Kitchin cycle (inventory, e.g. pork cycle) | 3–5 |

| Juglar cycle (fixed investment) | 7–11 |

| Kuznets swing (infrastructural investment) | 15–25 |

| Kondratiev wave (technological basis) | 45–60 |

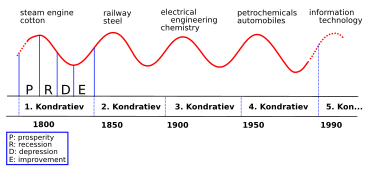

In economics, Kondratiev waves (also called supercycles, great surges, long waves, K-waves or the long economic cycle) are hypothesized cycle-like phenomena in the modern world economy.[1] The phenomenon is closely connected with the technology life cycle.[2]

It is stated that the period of a wave ranges from forty to sixty years, the cycles consist of alternating intervals of high sectoral growth and intervals of relatively slow growth.[3]

Long wave theory is not accepted by most academic economists.[4][better source needed] Among economists who accept it, there is a lack of agreement about both the cause of the waves and the start and end years of particular waves. Among critics of the theory, the consensus is that it involves recognizing patterns that may not exist (apophenia).

- ^ The term long wave originated from a poor early translation of long cycle from Russian to German. Freeman, Chris; Louçã, Francisco (2001) pp 70

- ^ Ayres, Robert U. (1988). "Barriers and breakthroughs: an "expanding frontiers" model of the technology-industry life cycle". Technovation. 7 (2): 87–115. doi:10.1016/0166-4972(88)90041-7.

- ^ See, e.g. Korotayev, Andrey V.; Tsirel, Sergey V. (2010). "A Spectral Analysis of World GDP Dynamics: Kondratiev Waves, Kuznets Swings, Juglar and Kitchin Cycles in Global Economic Development, and the 2008–2009 Economic Crisis". Structure and Dynamics. 4 (1): 3–57.

- ^ Skwarek, Shane (3 November 2015). "Kondratieff Wave". CMT Association. Retrieved 2018-12-20.