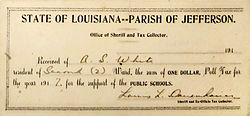

Poll taxes in the United States is the history of the use of poll tax (tax of a fixed sum on every liable individual, without reference to income or resources) across the US. Poll taxes had been a major source of government funding among the colonies and states which formed the United States. Poll taxes became a tool of disenfranchisement in the South during Jim Crow, following the end of Reconstruction. This practice was commonplace until it was outlawed in 1965, following the Voting Rights Act of 1965, which is considered one of the most monumental pieces of civil rights legislation ever passed. The Twenty-fourth Amendment to the United States Constitution was the impetus for this act, which prohibited both Congress and the states from implementing poll taxes, but initially this only included Federal elections, and was not enforced until the Voting Rights Act of 1965 was passed.