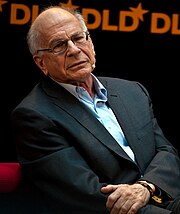

Prospect theory is a theory of behavioral economics, judgment and decision making that was developed by Daniel Kahneman and Amos Tversky in 1979.[1] The theory was cited in the decision to award Kahneman the 2002 Nobel Memorial Prize in Economics.[2]

Based on results from controlled studies, it describes how individuals assess their loss and gain perspectives in an asymmetric manner (see loss aversion). For example, for some individuals, the pain from losing $1,000 could only be compensated by the pleasure of earning $2,000. Thus, contrary to the expected utility theory (which models the decision that perfectly rational agents would make), prospect theory aims to describe the actual behavior of people.

In the original formulation of the theory, the term prospect referred to the predictable results of a lottery. However, prospect theory can also be applied to the prediction of other forms of behaviors and decisions.

Prospect theory challenges the expected utility theory developed by John von Neumann and Oskar Morgenstern in 1944 and constitutes one of the first economic theories built using experimental methods.

- ^ Kahneman, Daniel; Tversky, Amos (1979). "Prospect Theory: An Analysis of Decision under Risk" (PDF). Econometrica. 47 (2): 263–291. CiteSeerX 10.1.1.407.1910. doi:10.2307/1914185. ISSN 0012-9682. JSTOR 1914185.

- ^ "The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 2002". NobelPrize.org. Retrieved August 12, 2020.