| Part of a series on |

| Taxation |

|---|

|

| An aspect of fiscal policy |

Taxation in Sweden on salaries for an employee involves contributing to three different levels of government: the municipality, the county council, and the central government. Social security contributions are paid to finance the social security system.

Income tax on salaries is deducted by the employer (a PAYE system) and paid directly by the employer to the Swedish Tax Agency (Skatteverket).

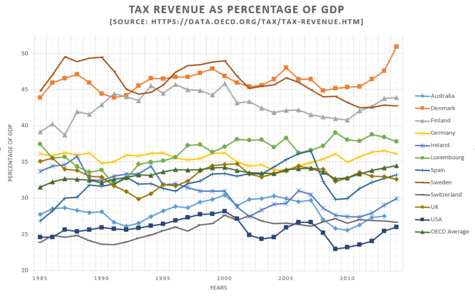

The effective taxation rate in Sweden is commonly cited as among the highest in the world; see list of countries by tax rates.

Sweden has a taxation system for income from work that combines an income tax (paid by the employee) with social security contributions (employers contributions) that are paid by the employer. The total salary cost for the employer is thereby the gross salary plus the payroll tax. The employer makes monthly preliminary deductions (PAYE) for income tax and also pays the payroll tax to the Swedish Tax Agency.

The income tax is contingent on the person being taxable in Sweden, and the social security contributions are contingent on the person being part of the Swedish social insurance plan. The income tax is finalised through a yearly tax assessment the year following the income year.[1]

27% of taxpayer money in Sweden goes towards education and healthcare, whereas 5% goes to the police and military, and 42% to social security.[2]

- ^ "För arbetsgivare". www.skatteverket.se (in Swedish). Swedish Tax Agency.

- ^ "Offentliga sektorns utgifter". August 22, 2017.