The examples and perspective in this article may not represent a worldwide view of the subject. (September 2010) |

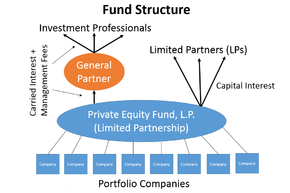

Private equity funds and hedge funds are private investment vehicles used to pool investment capital, usually for a small group of large institutional or wealthy individual investors. They are subject to favorable regulatory treatment in most jurisdictions from which they are managed, which allows them to engage in financial activities that are off-limits for more regulated companies. Both types of fund also take advantage of generally applicable rules in their jurisdictions to minimize the tax burden on their investors, as well as on the fund managers. As media coverage increases regarding the growing influence of hedge funds and private equity, these tax rules are increasingly under scrutiny by legislative bodies.[2] Private equity and hedge funds choose their structure depending on the individual circumstances of the investors the fund is designed to attract.

- ^ Fleischer, Victor (2008). "Two and Twenty: Taxing Partnership Profits in Private Equity Funds". New York University Law Review. SSRN 892440.

- ^ Michael S. Knoll, Article: The Taxation of Private Equity Carried Interests: Estimating the Revenue Effects of taxing Profit Interests as Ordinary Income, 50 WM. & MARY L. REV. 115, 117 (2008).