This article needs additional citations for verification. (February 2022) |

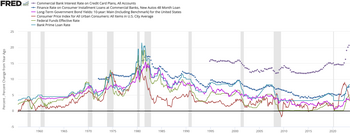

The U.S. prime rate is in principle the interest rate at which a supermajority (3/4ths) of American banking institutions grant loans to their most creditworthy corporate clients.[1] As such, it serves as the de facto floor for private-sector lending, and is the baseline from which common "consumer" interest rates are set (e.g. credit card rates). Traditionally, the rate is set to approximately 300 basis points (or 3 percentage points) over the federal funds rate. The Federal Open Market Committee (FOMC) meets eight times per year wherein they set a target for the federal funds rate.

In the United States, the prime rate is traditionally established by the Wall Street Journal.[2] Every major bank sets its own prime rate. When 23 out of the 30 largest US banks change their prime rate, the Journal publishes a new prime rate.

- ^ "Prime Rate". Investopedia. June 30, 2020. Retrieved December 26, 2021.

- ^ "Money Rates". Wall Street Journal. Retrieved December 26, 2021.